Whether you’re an employee, manager, or business owner, you’ll need to deal with pay stubs from time to time. You’ll either need to know how to create one, check it for errors, or interpret it.

So, what is a pay stub exactly? Put simply, it’s a document that breaks down an employee’s pay and deductions for the period. It helps an employee see what earnings they received and which deductions the employer has taken out.

Read on to learn more about pay stubs and to find out what they contain, why they’re used, and how to make them.

What Is a Pay Stub, and Why’s It Important?

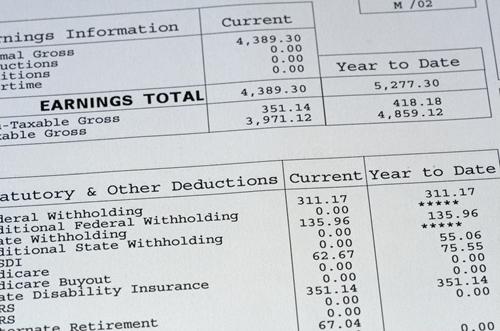

A pay stub serves as documentation for hours worked, earnings received, and deductions such as taxes, insurance, and retirement plans. It usually also shows any employer contributions and calculations for any paid time off and sick days. In addition to showing data for the pay period, a pay stub usually includes year-to-date information too.

A pay stub can come in paper form attached to the employee’s paycheck. It may also be electronic and accessed through the company’s employee portal.

Employers often need to make pay stubs to adhere to state laws. It also helps employers when tax time comes around.

Employees rely on pay stubs to verify their earnings and deductions. They may also need to present pay stubs as part of applying for a loan or other program that requires documenting income.

What Do They Show?

When looking at employment pay stubs, you’ll notice that the top section usually shows the employee’s and employer’s information. This includes names and addresses for both and the employee’s Social Security number.

You’ll also see information about the employee’s pay rate along with the dates the pay stub covers. The pay stub then breaks down earnings, taxes, deductions, and contributions.

You’ll see gross earnings based on your hourly pay or salary. This means your wages before any deductions get taken out.

You’ll also see a list of federal, Medicare, Social Security, and state taxes that are deducted. This may include both the portions the employee and employer will pay. You’ll also see other deductions like your 401(k) and health insurance.

Lastly, you’ll find your net pay, or how much the actual check is for. This is the earnings left over after all deductions get subtracted.

How Are They Made?

Employers have a few options for creating pay stubs. For example, they could use an Excel spreadsheet with a pay stub template if they only have a few employees.

But in most cases, employers use payroll software to automate the process, improve accuracy, and boost efficiency. You can learn more here about an easy-to-use pay stub maker that works for any state.

Now You Know All About Pay Stubs

Now you won’t have to wonder, “What is a pay stub?” If you’re interested in more information, try looking at a pay stub example, but remember that the format can vary by employer.

If you’re an employer, you should have a better understanding of the content, uses, and ways of creating this document. If you’re an employee, you can better understand all the information shown about your pay and deductions. In either case, it’s helpful to check the pay stub for accuracy to avoid issues with incorrect pay or tax issues.

Be sure to check out our other business posts for more tips!